Research summary

Professional portfolio management paves the way for participant well-being

July 06, 2022

More than 100 million Americans use defined contribution plans, making these investor-led accounts the centerpiece of the private-sector retirement system in the United States. Vanguard’s How America Saves 2022 report, drawn from the data of 5 million retirement plan participants, uncovered a wealth of participant behaviors and trends and identified three key insights. Here we discuss one of those trends—the increased use of professionally managed allocations—and how it has enhanced participant outcomes.

More rebalancing, less trading

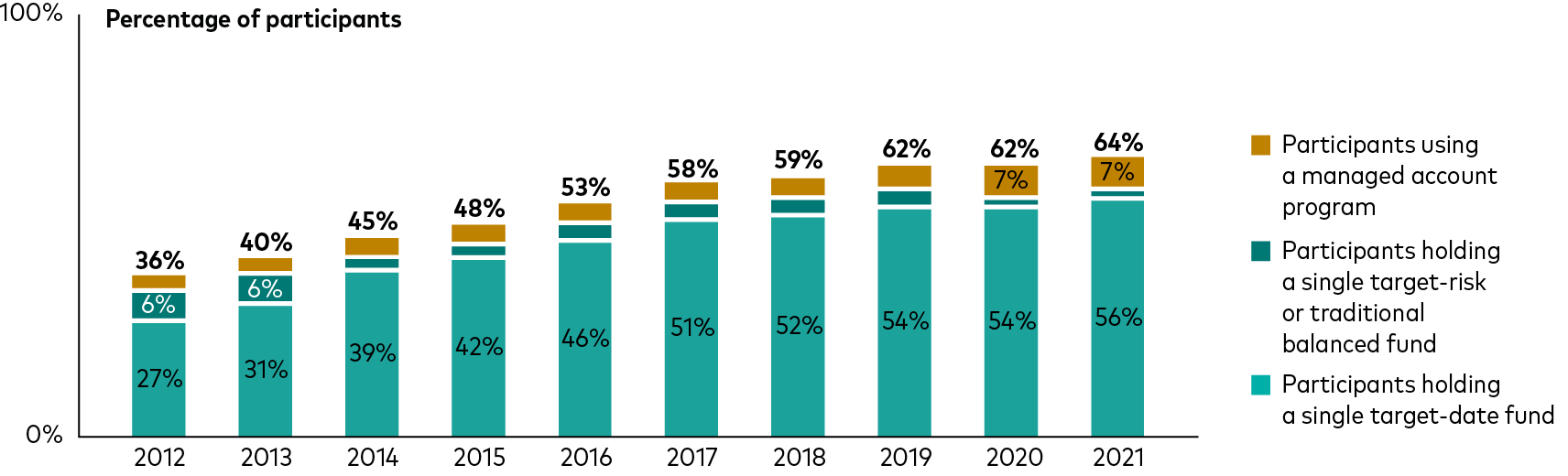

In 2021, the percentage of defined contribution plan participants using professionally managed portfolios—which can include target-date funds, managed account programs, and traditional balanced funds—reached an all-time high of 64%. The vast majority of these participants held their plan assets in a single target-date fund.

Participants with professionally managed allocations

Vanguard defined contribution plans

Source: Vanguard, 2022.

“One of the primary benefits of target-date funds is continual rebalancing—which is especially important during volatile markets like the one we’re in right now,” said Jeff Clark, author of How America Saves 2022 and a member of the Vanguard Strategic Retirement Consulting team. “The research has shown that pure target-date-fund investors are about five times less likely to trade compared with other investors.”

In short, the shift toward professionally managed portfolios helps participants stay the course, even—or perhaps especially—during choppy markets.

Professional portfolio management enhances portfolio diversification

Another boon associated with the uptick in professionally managed portfolios: a huge increase in diversification levels. In 2005, just 39% of participants maintained a balanced strategy. By 2021, that number had shot up to 78%.

“If you look back over the past 15 years, there has been a dramatic shift toward more age-appropriate allocations,” said Clark. “That shift is even more pronounced among younger participants, who have greater potential to benefit from the power of compounding,” said Clark.

Trend in asset allocation by participant age

Vanguard defined contribution plans (average equity allocation participant weighted)

![Line chart shows trends in asset allocation by participant age during four years: 2005, 2010, 2015, and 2021. In 2005, younger participants [(those age 25 or under)], held less than 60% in equities and, in peak-equity years (35–44), never reached 75%. The equity allocation bottomed around 40% at age 70+. In 2010, investors aged 25 and younger held an equity allocation greater than 80%; that number trended downward throughout the age cohorts, bottoming at around 40% at age 70+. In both 2015 and 2021, equity allocations for those under age 25 around 90%, remaining elevated through a good part of middle age, then bottoming out at slightly more than 40% at age 70+.](/content/dam/corp/articles/images/has-portfolio-management/has_portfolio_management_2.png)

Source: Vanguard, 2022.

Incorporating elements of professional portfolio construction in plan design

Vanguard’s Insights to Action commentary, which complements the How America Saves 2022 report, identified three key ways that plan sponsors can support participants’ financial well-being with professionally managed allocations. In designing their plan, sponsors would do well to:

- Offer an advice option (as discussed here);

- Establish a qualified default investment option (QDIA)—and make that QDIA a target-date fund; and

- Reenroll participants into an appropriate target-date fund.

The takeaway for plan sponsors? Taking one or more of these steps can encourage properly diversified portfolios across age cohorts and help boost participants’ long-term financial success.

Notes:

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Diversification does not ensure a profit or protect against a loss.

Investments in target-date funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the work force. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. An investment in target date funds is not guaranteed at any time, including on or after the target date.

Contributor

Jeff Clark