Investor outcomes

Our aim is simple: Help investors succeed

A critical element of investment success is superior performance. A critical element of superior performance is low cost.

Bettering long-term outcomes

Clients entrust their money to Vanguard in pursuit of financial security and dreams.

Our responsibility is to invest client assets with care and prudence. In seeking to improve investor outcomes, we strive to provide investment returns that, with reasonable consistency and over the long term, exceed the average returns of competing funds with comparable policies and risk parameters. Low costs enable superior performance, and our funds and ETFs are among the lowest in cost.

In fact, Vanguard has led the low-cost revolution in the investment management industry. Our structure and scale have enabled us to reduce the expense ratios on our U.S. funds continually and consistently.1 For most of the rest of the industry, fee reductions are a recent phenomenon, a reaction to competitive pressure as investors flock to low-cost investments. A respected industry observer dubbed this “the Vanguard effect,” and it has taken hold across the globe.2 The Vanguard effect reflects the tendency of asset managers to reduce their fees after Vanguard has entered a market or introduced products in a certain category. Competitors follow suit, which results in lower costs for all investors.

Note: Data reflect the assets under management and expense ratios of all U.S.-domiciled mutual funds and exchange-traded funds, as of December 31, 2024.

Sources: Vanguard and Morningstar, Inc..

Our ownership structure

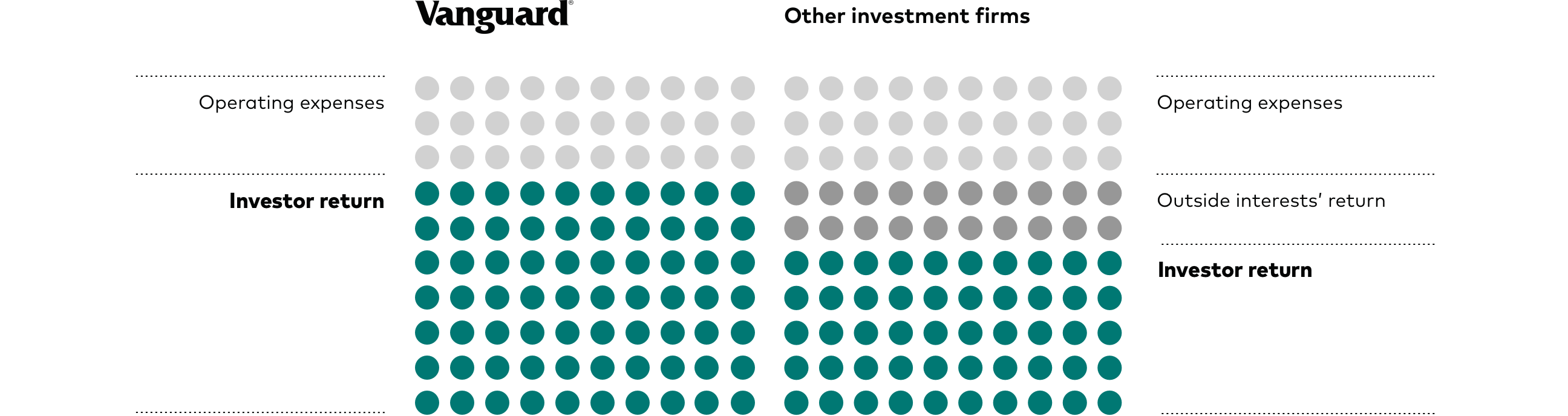

Our investors are our owners; most other mutual fund management companies are owned by third parties—either public or private stockholders—who expect to profit from their ownership.3 Our unique structure directly benefits our fund shareholders, as we can consistently pass along profits to reduce the cost of investing for clients.

Lower costs enable investors to capture greater portions of their investments' gross returns. And when investors keep more of their earnings, they considerably improve their investment outcomes.

Note: This hypothetical illustration depicts the impact of Vanguard's ownership structure. All other factors being equal, Vanguard's ownership structure may allow investors to keep more of their investment returns. The proportions shown do not represent the distribution of returns on any particular investment.

1 Vanguard is owned by its funds, which are owned by Vanguard’s fund shareholder clients.

2 Source: Morningstar, 2009.

3 Vanguard is owned by its funds, which are owned by Vanguard’s fund shareholder clients.

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.