Research summary

Three strategies to boost employee retirement savings

July 26, 2022

Employees of firms who use Vanguard’s retirement plan platform participated at a record-breaking rate of 81% last year—mainly thanks to the increased use of automatic enrollment in plan design. Vanguard’s How America Saves 2022 report, drawn from the data of nearly 5 million retirement plan participants, uncovered a wealth of such participant behaviors and trends. It also identified three key insights that can be used to augment smart plan design. Here we discuss one of those trends—plan features that boost savings rates—and how it affects participant outcomes.

Higher defaults lead to stronger savings

“Vanguard recommends a total annual savings rate of at least 12% to 15%. That includes both the employee contribution and employer match components,” said Jeff Clark, author of How America Saves 2022 and a member of the Vanguard Strategic Retirement Consulting team. “Plan sponsors should think about the quickest way to get their employees to those optimal savings rates.”

A modest increase in deferral rates—of just 1, 2, or 3 percentage points—could push an additional 20% of current participants into a total savings rate that sets them up to achieve a projected 75% income replacement ratio in retirement. That’s according to the Vanguard retirement saving rate index research report, which includes information about how small financial moves can have a large impact on a worker’s long-term financial well-being.

Even better: Vanguard platform participants are well on their way toward meeting that target. Their average deferral rate stood at an average of 7.3% last year, up modestly from 6.8% in 2016. Two trends drove this change: More plans have launched an automatic enrollment feature while default deferral rates have also increased over time.

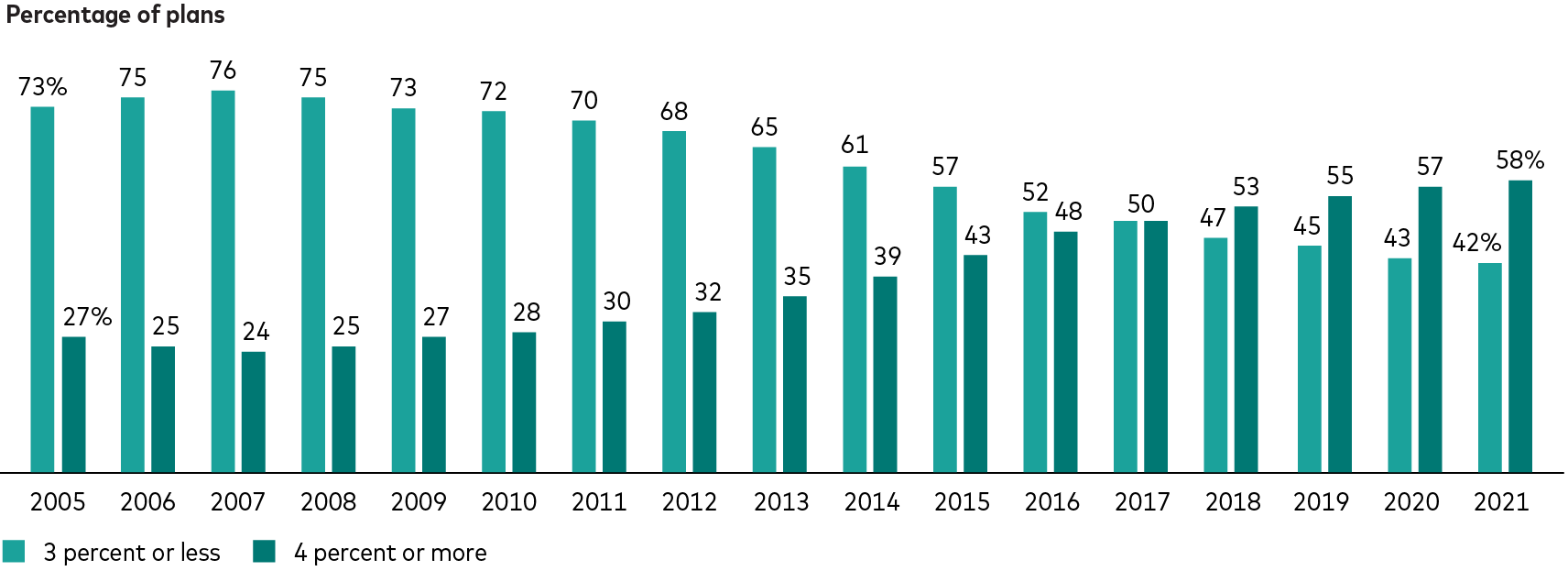

Automatic enrollment default trends

Vanguard defined contribution plans with automatic enrollment

Source: Vanguard, 2022.

Vanguard recommends that plan sponsors take the following three actions:

1. Incorporate an automatic enrollment feature

Plans with voluntary enrollment have a 66% participation rate on average. Add an autoenrollment feature and average participation jumps to 93%. “We’re encouraged by the continued adoption of automatic enrollment,” said Clark. “Three out of four large plans—that’s plans with 1,000 or more participants—now offer this feature.”

2. Set the default deferral contribution rate to 6% (or at least to a rate that captures the employer match)

In general, participants tend to not change their behavior; it takes a lot to get them to act. Sponsors can leverage this inertia in their plan design by setting higher default deferral rates. Our research shows that opt-out rates do not change based on default rates (i.e., a higher default rate does not mean that more participants opt out). Retirement plans are continuing to improve their plan design to quickly get more participants closer to their optimal savings rate. Last year, 27% of Vanguard plans had a default contribution rate of at least 6%. This proportion is more than double what it was 10 years ago.

3. Systematize reenrollment, automatic escalation, and undersaver sweeps

For plans that already have a strong enrollment program, adding features like reenrollment, automatic escalation, and undersaver sweeps (periodically “sweeping” eligible nonparticipants into the default design) can help get more participants closer to a 75% retirement income replacement value. “We see a lot of participants who are tethered to the employer match rate. The addition of an automatic escalation feature can gradually increase savings and help participants reach an optimal savings rate,” said Clark. “And, if participants are already saving at the employer match rate, there’s no additional cost to the employer—which makes this feature a cost-neutral solution for improved savings.”

By taking any of these three small steps—or a combination of several—plan sponsors can help boost employee financial wellness.

Notes: All investing is subject to risk, including the possible loss of the money you invest.

Contributor

Jeff Clark