Euro area, United Kingdom

Our economic and market outlook at midyear 2022

July 13, 2022

We expect notably slower economic growth in 2022 than we had at the start of the year, primarily because inflation has eroded consumers’ purchasing power and lowered business confidence. Central banks’ efforts to contain inflation will play an additional role in slowing the economy.

“Energy prices sent soaring by the war in Ukraine drive changes to our outlook. Natural gas prices and supply are especially fraught issues for the euro area.”

—Jumana Saleheen, Vanguard European chief economist.

Euro area

2%–3%

Economic growth

We’ve twice downgraded our outlook this year because of higher energy prices—once before and once after Russia’s invasion of Ukraine. Risks are growing, though recession in the next 12 months isn’t a foregone conclusion. But a complete cutoff from Russian natural gas would almost certainly lead to rationing and recession.

~8%-8.5%

Headline inflation

We expect headline inflation to peak close to 10% in the third quarter, higher than current record levels. But by the end of 2023, we foresee inflation falling back toward the European Central Bank’s 2% target. For now, European consumers grapple with rapid price rises that extend to an array of goods and services.

0.5%–0.75%

Monetary policy

The European Central Bank has signaled a July interest rate hike. We expect the deposit rate to move into positive territory in the third quarter for the first time since 2012. The ECB has turned hawkish recently given broadening inflation pressures. “Fragmentation risk” complicates matters: The ECB manages policy for 19 nations.

~7%

Unemployment rate

We foresee the labor market remaining historically strong with a comparatively low unemployment rate by year-end. Wage pressures continue to build as job vacancy rates have risen to new records.

What to watch

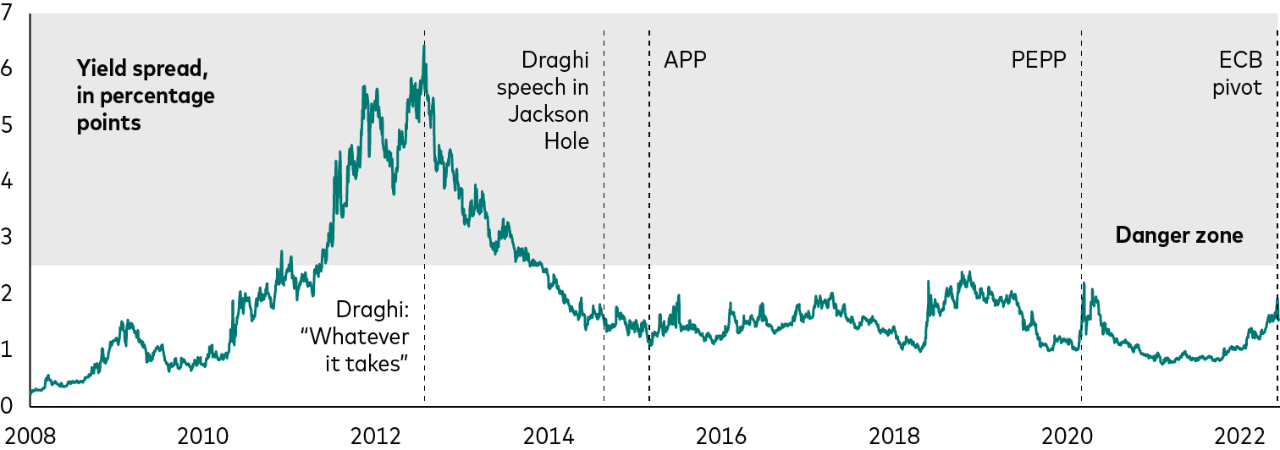

Many nations, one policy rate

The European Central Bank has accelerated the development of a tool to fight “fragmentation risk,” a widening of sovereign debt spreads because of nonfundamental factors. The tool’s creation supports our base case that the ECB will be able to raise interest rates more aggressively while avoiding a scenario of sovereign stress.

Notes: Yield spread represents the interest rate premium to 10-year German bunds of a market-capitalization-weighted composite of 10-year yields in Spain, Italy, Greece, Portugal, and Ireland. Key events affecting spreads include then-ECB President Mario Draghi’s July 2012 pledge to do “whatever it takes” to preserve the euro; Draghi’s August 2014 Jackson Hole, Wyo., speech heralding monetary stimulus; the January 2015 introduction of the nonstandard Asset Purchase Programme (APP) monetary policy vehicle; the March 2020 introduction of the nonstandard Pandemic Emergency Purchase Programme (PEPP) monetary policy vehicle; and a June 2022 ECB news conference heralding aggressive monetary policy tightening. Spreads above 2.5% are typically said to have entered a “danger zone” likely to spur policy action.

Sources: Vanguard calculations, based on data from Bloomberg through June 20, 2022.

United Kingdom

3.5%–4%

Economic growth

Our 2022 growth forecast is down sharply from 5.5% at the start of the year. Higher commodities prices, tighter financial conditions, and diminished consumer and business confidence mean that risks are pointedly to the downside. Fiscal policy measures and anticipated wage increases are unlikely to prevent a drop in real incomes.

~10%

Headline inflation

Energy prices are likely to drive year-on-year inflation briefly past 10% in the fourth quarter as a higher price cap lets suppliers charge more. We foresee year-end headline inflation about three times what we had expected at the start of the year, before the war in Ukraine sent energy and commodities prices soaring.

2.25%–2.5%

Monetary policy

We believe the Bank of England will raise the bank rate by an additional 1.25 percentage points, toward our estimate of a 2.5% neutral rate, over the next 12 months.* The bank has signaled rate hikes potentially larger than 25 basis points depending on the economic and inflationary outlook.

~4%

Unemployment rate

Unemployment near a 50-year low amid record job vacancies suggests that the labor market will remain strong the rest of the year even as the economy slows. The push-pull of wage growth, inflation, and economic activity will be important as the Bank of England considers appropriate monetary policy levels.

What to watch

Real incomes under pressure

A sharp decline in real (after-inflation) earnings in 2022 is likely to weigh on economic growth. We foresee the trend moderating alongside headline inflation in 2023 en route to a return to equilibrium over the longer term.

Notes: Real wage growth is calculated as the year-on-year percentage change in average nominal weekly earnings minus the year-on-year percentage change in the headline inflation rate. The figure for 2022 reflects actual data and forecasts using proprietary indicators. The figures for 2023 and 2030 are Vanguard forecasts.

Sources: Vanguard calculations, based on data from Bloomberg and Macrobond, as of June 27, 2022.

The outlook for emerging Europe

Emerging Europe, like emerging markets more broadly, continues to face headwinds from slowing growth in the United States, the euro area, and China, as well as from developed markets’ central bank tightening and from domestic and global inflation. We recently downgraded our forecast for full-year 2022 growth in emerging markets globally, from about 5.5% at the start of the year to about 3%. Markets are starting to price in 2023 central bank interest rate cuts for emerging Europe in expectation of slowing growth.

Figures related to economic growth, inflation, monetary policy, and unemployment rate are Vanguard forecasts for the end of 2022. Growth and inflation are comparisons with year-end 2021; monetary policy and unemployment rate are absolute levels.

*The neutral rate is the theoretical interest rate at which monetary policy neither stimulates nor restricts an economy.

A closer look

Our midyear 2022 outlook

Recession isn’t a forgone conclusion, but curbing inflation without stifling growth will be hard.

Americas

A U.S. “soft landing” is looking less likely with the Federal Reserve’s higher policy rate landscape.

Asia-Pacific

China’s growth target of about 5.5% is vulnerable given the weak labor market and slowing global growth.

10-year asset-class returns

Falling equity valuations and rising interest rates have largely increased our return forecasts.

Time-varying portfolios

Strategic asset allocation, not market timing, may benefit some investors given changing conditions.